You are here

- Home

- Business and Law in the time of COVID-19

- Taxing financial winners from coronavirus to pay for the crisis – lessons from WW1

Taxing financial winners from coronavirus to pay for the crisis – lessons from WW1

The enormous impact of COVID-19 on the world has drawn comparisons with the first world war. Historian Niall Ferguson, for example, points to the financial panic, global reach, economic dislocation and popular alarm of both crises. Both events have cost the UK enormous sums, driving government debt today to over £2 trillion, equivalent to over 100% of GDP. In 1919, it was even higher at 135% of GDP. Both crises, though, have also generated winners as well as losers with respect to finance, as well as health.

We are now in the second wave of the COVID-19 virus and have no idea how much this pandemic will eventually cost. But we can learn lessons from the first world war and subsequent crises on how to reduce the final bill. Faced with a similar dilemma in 1915, the war cabinet’s solution was to target the financial winners from the war with a special tax. More recently, Margaret Thatcher and Gordon Brown adopted a similar strategy during hard economic times. Today’s government can learn from this approach by targeting those organisations that have profited from the pandemic to help those that are struggling.

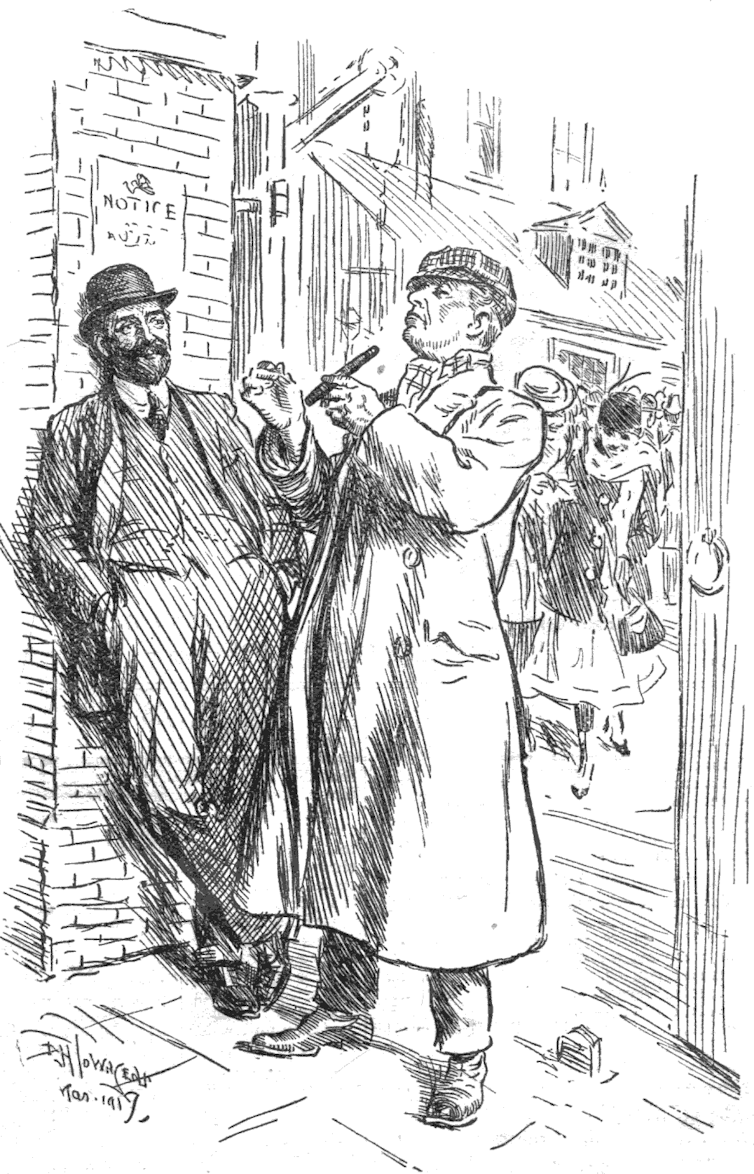

During the first world war, despite the suffering, there were some financial winners, even among working-class families. Labour shortages caused wages to rise and women took the absent men’s jobs or worked in the newly established munitions factories. This all added to the household budget. A cartoon in satirical magazine, Punch in 1917 shows a munitions worker at the factory gates wearing a smart overcoat and smoking a cigar, telling his friend he has just bought a piano.

Punch magazine cartoon from 1917 where a munitions worker tells his friend he’s just bought a piano.

Some companies also profited from the war. In 1915, Spillers and Bakers, a flour-milling company, felt obliged to apologise to the nation for having made profits of £300,000 compared with £50,000 before the war. Sectors such as shipping, or that supplied the army with weapons, uniforms and food supplies, did well too.

These gains were seen by the British public as profiteering. In response, the government imposed a tax called Excess Profits Duty on companies that were profiting from the war. Initially, this was a 50% tax on any war-time profits in excess of average profits before the war, after allowing for a 6% return on capital. It was such a successful tax that it remained in place until 1921 at various rates of between 40% and, at its peak, 80%.

Today, there are also individual and corporate financial winners, this time from the COVID-19 pandemic. Those families who have been able to live through lockdown by working from home in large houses with gardens are some of the winners.

Companies in sectors such as personal protective equipment manufacturing, home delivery, online entertainment, IT, consultancy services, banks and social media have certainly made excess profits compared to the world prior to COVID-19. Some of these profits could easily be used to fund wages for employees of businesses closed during lockdowns.

There is no shortage of COVID-19-related costs to cover. Excess profits from the crisis should be taxed, as during WWI, for as long as the crisis lasts. Some more recent examples show how this might be possible.

Some companies have boomed in lockdown.

Windfall tax precedents

Governments on both sides of the political divide have used these kinds of taxes to plug holes in public spending at times of need in the past. Or simply when profits were deemed too high. Margaret Thatcher, for example, levied a one-off tax on the banks in 1981, netting £400m. The government needed the money; it was having difficulty issuing government bonds to fund the holes in the country’s finances.

At a time of high unemployment and inflation, the banks were making substantial profits from high interest rates and were seen as fair game. In the same year, with a booming oil price, Thatcher also squeezed North Sea oil and gas companies for cash by imposing a supplementary petroleum duty of 20% of gross revenue on each oil field with the first 20,000 barrels duty free, on top of already heavy taxation.

Then, in 1997, as chancellor of the exchequer in the new Labour government, Gordon Brown raised £5.2 billion by imposing a windfall tax on privatised utility companies which, he argued, had been sold off much too cheaply. The tax imposed was based on the difference between the (lower) amount received by the government on privatisation and the (higher) amount the government would have received if the substantial profits the privatised utilities actually did make after privatisation had been taken into account.

The most recent windfall tax was imposed in 2010 by Alastair Darling, the then chancellor. It was a tax of 50% on bankers’ bonuses of more than £25,000 – payable by the banks and not the individual bankers. Expected to raise £550 million, it raised £3.4 billion as investment banks failed to reduce bonuses by as much as the government had expected. Bankers were under the spotlight at the time, accused of being responsible for the global financial crisis of 2008.

These examples show creativity, flexibility and opportunism by successive governments in designing taxes to soak up excess profits. Until now, under substantial pressure, the current government has had little time to ponder how to claw back the equivalent high profits from the pandemic. But as unemployment rises and the number of financial losers increase, now is the time to restore the playing field by taxing the financial winners. There are plenty of examples to draw on.

Janette Rutterford, Emeritus Professor of Finance and Financial History, The Open University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

![]()

Upcoming Events

Navigating Migration and Employment: Opportunities for Inclusive Futures

Tuesday, June 3, 2025 - 11:00 to 13:00

Online with Microsoft Teams

The Liminal Spaces of the Regional Economy

Wednesday, June 4, 2025 - 14:00 to 15:30

Online - via Teams