You are here

- Home

- Study

- Postgraduate Qualifications

- MSc in Finance

MSc in Finance

Devendra Kodwani, Professor of Financial Management and Corporate Governance, talks about the Masters in Finance qualification.

Ready to register?

The MSc in Finance is a specialist qualification that supports professional and practice development for a wide range of roles in finance. It’s also ideal for career changers aspiring to work in the sector.

Globally endorsed

Our triple-accredited status puts us in an elite group of just one per cent of business schools worldwide.

Professional recognition

The Open University MSc in Finance has been accepted into the CFA Institute's University Affiliation Program. This status is granted to institutions whose degree programmes incorporate at least 70% of the CFA Program Candidate Body of Knowledge (CBOK) – providing students with a solid grounding in the CBOK and positioning them well to sit CFA exams.

Course content

This course provides an up-to-date perspective on both theory and practice in national and international contexts, and a thorough grounding in areas such as corporate finance, financial decision-making, financial reporting and governance – as well as the fundamentals of Islamic finance and behavioural finance.

You will also have the opportunity to develop and apply essential tools for financial, statistical and econometric analysis, and for decision support – building skills in data collection and modelling using databases such as Datastream and Thomson One, and statistical software such as STATA.

You can choose to specialise in derivatives and financial risk management, or in investment and portfolio management. You will also learn to evaluate published research and apply research methods and techniques to new situations by completing a dissertation on a topic of your choice.

I would recommend the OU Business School to anyone because of the high level of tuition and online material on offer. The degrees are recognised worldwide and competitively priced. Flexibility of learning is a major plus for those students who have a full-time job.

John Gibson

MSc in Finance Dissertation of the Year Award winner 2019 Read John's story

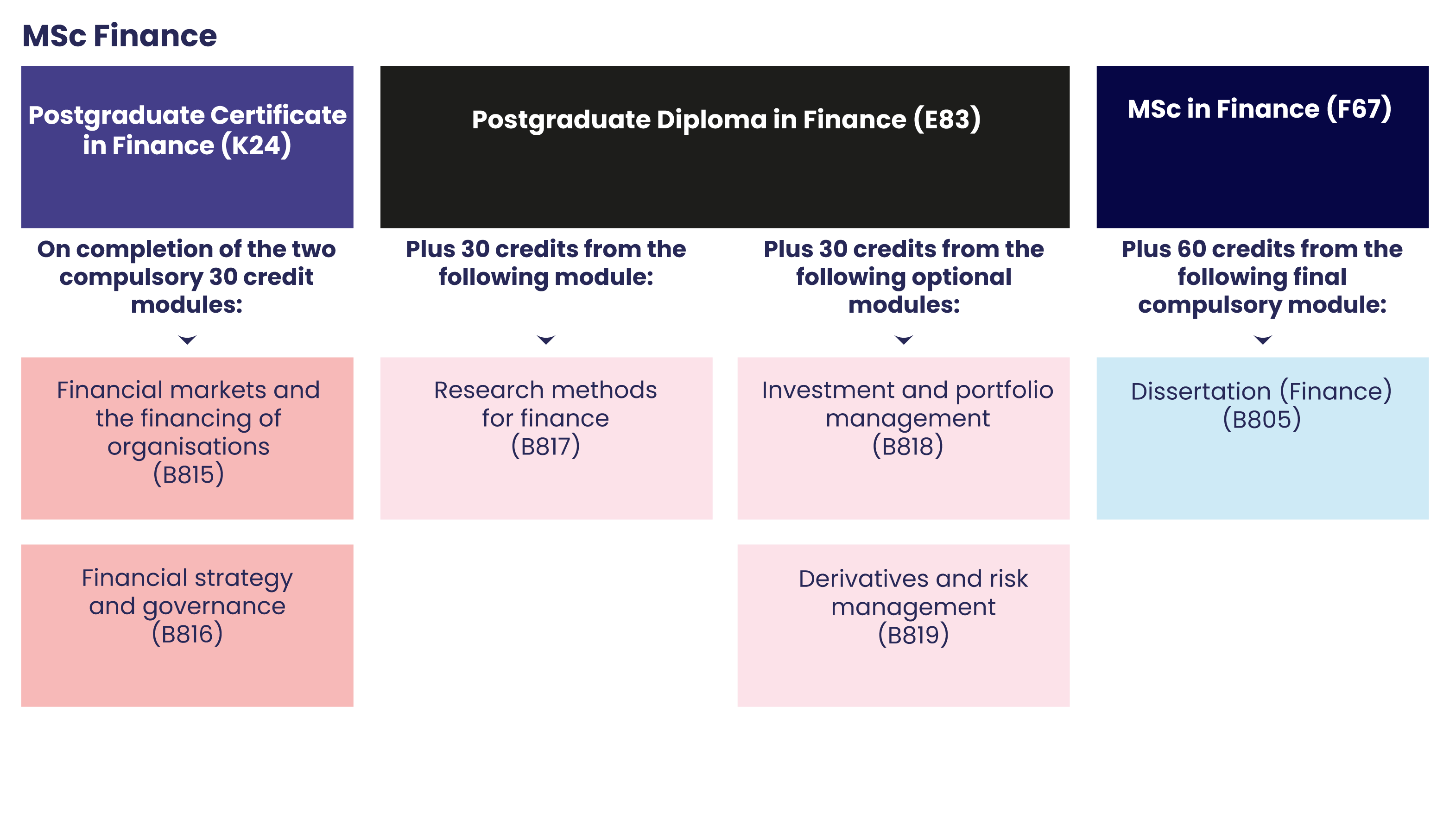

Qualification structure

Most students study this qualification in three years by studying 60 credits a year. The minimum time to complete this qualification is two years. This can be achieved by studying 120 credits in your first year, which is the equivalent of full-time study, and the 60-credit dissertation module during your final year. The maximum time to complete is seven years.

Please note: if you hold a professional accountancy qualification you may be eligible to transfer 30 credits towards the MSc in Finance.

Descriptions of all modules are available on the MSc in Finance qualification page.

Career development

Students will acquire knowledge and skills that are highly relevant to a wide range of roles in finance, including investment and portfolio management, corporate finance and treasury, consultancy and investment banking. They will also have the opportunity to develop and apply quantitative research tools, forming their own criticisms and opinions on finance theory and practice.

The MSc in Finance is aimed at both UK and international students to prepare them for the increasingly diverse global economy. In addition, it offers students the choice to specialise in risk or portfolio management to suit their career choices. More generally, by studying for a postgraduate business qualification, students can expect a positive impact on their career progression.

For employers, the MSc in Finance will further develop their employees’ skill set and support improvements to working practices in the organisation.

Credit transfers

CFA level III charterholders can obtain exemptions from the first two compulsory modules. If you have a professional qualification in a related area, such as ACCA, CIMA or ICAEW, you may also be eligible for an exemption from the: Financial markets and the financing of organisations (B815) 30 credits module.

If you’ve successfully completed some relevant postgraduate study elsewhere, you might be able to count it towards this qualification, reducing the number of modules you need to study. You should apply for credit transfer as soon as possible, before you register for your first module.

For more details and an application form, visit our Credit Transfer website.

Ready to register?

Request your prospectus

Explore our qualifications and courses by requesting one of our prospectuses today.

Request prospectus